n this April 2025 Strategist’s Corner, MFS’s Robert Almeida explores how tightening liquidity conditions and macro headwinds may reshape equity performance, especially in the U.S. market.

- Elevated trading volumes in April contrast with diminished liquidity, amplifying volatility and exposing vulnerable assets.

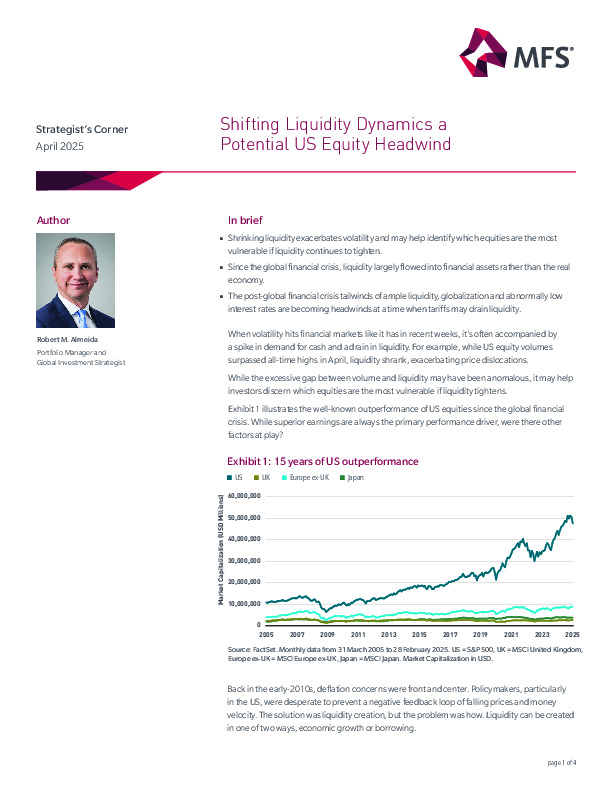

- U.S. equities have long benefited from post-GFC tailwinds—low rates, globalization, and stimulus-fueled liquidity—but these are now turning into headwinds.

- Liquidity-driven outperformance is fading, and higher-duration U.S. tech stocks are increasingly sensitive to liquidity shocks.

Read the full report for insights into how shrinking liquidity and global policy shifts could alter long-term equity strategy.

limited_access.body_anonymous